Civil litigation is a business process. The expense must be reasonable, given the expected outcome. It is useful to estimate the expected return on investment.

Return on investment in litigation

To estimate the expected return on investment, we need two numbers: (a) the expected expense, and (b) the expected outcome. Of course, estimates of future outcomes are not as precise as looking back.

Return on investment is a ratio, and can be expressed as a percentage. The benefit of the investment, in dollars, is divided by the cost of the investment.

Any proposed litigation approach will have a cost. If a proposed litigation approach with its investment required does not have a positive ROI, or if there are other approaches with a higher return on investment, then the path should be not be taken.

In making the calculation, the client should be encouraged to provide an estimate of the value of resources required to support the litigation. Assumptions in the calculation should be made explicit.

Note: an important consideration is the relative financial strength of each side. In some expensive litigation, the matter may exhaust the resources of a party.

Litigation Expense estimate

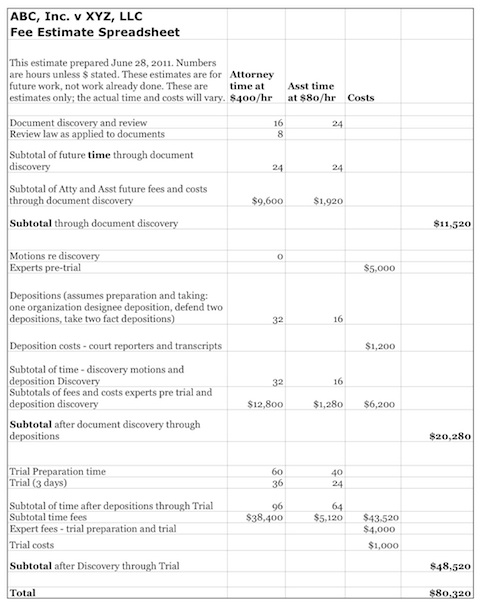

Expenses are easier to estimate than the outcome of the litigation. A spreadsheet is clear way to set out the assumptions and the expense as time goes by. Because the expense of litigation depends heavily on when the case resolves, the better estimates are given by phase. For example,

- document discovery,

- depositions,

- motions,

- preparing for trial,

- trial, and

- appeal if necessary.

A spreadsheet of estimated expenses of the litigation by phase is valuable to the clients. The assumptions should be stated. Such an organized estimate prevents wasteful expenditures or unfortunate surprises when litigation costs more than the client anticipates.

Related to this is the flat fee, instead of the hourly billing that became a law tradition starting in the 1950’s or so. The flat fee has the advantage of taking uncertainty out of the situation, but can be difficult to set if the case has unusual factors.

For a simple and straightforward hourly fee case, below is an example of an estimate in spreadsheet format.

Litigation Outcome estimate

This requires both analysis and courage. Even with a disclaimer about the uncertainty of trying to predict the future, many lawyers are hesitant to express even a range of outcomes. However, it is necessary to convey the information. One helpful approach is to consider the alternative outcomes, in broad terms, such as an excellent outcome, a good outcome, a bad outcome, or a worst case outcome.

Summary

For business litigation, business expenses should be justified by a return on investment. That is if you spend many thousands of dollars on litigation it should be with a specific purpose and goal in mind that would produce more return than if you don’t spend the money. However, many times litigation is just undertaken with no particular financial plan as to what it is going to cost and what you are trying to get.

Next Step

This article is only about financial strategy. Analysis of the expected financial aspect of litigation is necessary but not sufficient for a favorable outcome. For more information call E. J. Simmons at 503-221-2000 or email ejs@simmonstrialpractice.com.